- Rental Management Media Group

- Equipment rental industry remains resilient

Equipment rental industry remains resilient

By Erin Jorgensen

December 4, 2023

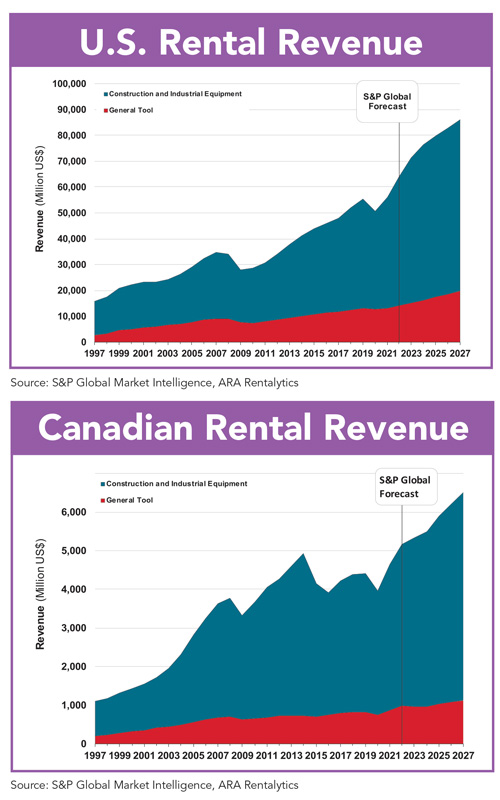

Equipment rental revenue, comprised of the construction/industrial and general tool segments, is expected to grow by 7.1 percent in 2024 to reach a record total of nearly $76.6 billion, topping the nearly $71.5 billion recorded in 2023, according to the latest forecast released in early November by the American Rental Association (ARA).

Equipment rental revenue, comprised of the construction/industrial and general tool segments, is expected to grow by 7.1 percent in 2024 to reach a record total of nearly $76.6 billion, topping the nearly $71.5 billion recorded in 2023, according to the latest forecast released in early November by the American Rental Association (ARA).

To better understand the economic factors leading to this forecast, Rental Management questioned Scott Hazelton, director, S&P Global Market Intelligence, the international forecasting firm that compiles data and analysis for the ARA forecast and ARA Rentalytics™ members-only subscription service as part of a research partnership with ARA.

Rental Management: Did anything surprise you in the latest ARA forecast?

Scott Hazelton: This quarterly update went pretty much as expected. After several months of surprises to the upside, economic growth came in close to what we expected.

Rental Management: Last quarter, there were some changes in the forecast due to two factors: the data on non-residential construction spending used in the model and the increasing importance of ‘specialty rental’ to overall rental revenues. How did that change the forecast model?

Hazelton: As a bit of background, the change to the non-residential construction data arose from analysis of other governmental data sources. In particular, we had been concerned for several months that the Census Bureau was underestimating construction spending. However, while there seemed to be inconsistencies between the Census data and other indicators, such as construction employment, there was no basis on which to change the numbers. In the spring, the Federal Reserve system performed some deep analysis into the Census methodology and determined the potential size of the underestimate. We used that analysis to adjust the data we use in the model. As such, the structure of the model did not change at all; only the values that we feed into it. As these were historical revisions, and the issue was primarily in 2021 and 2022, the impact was to increase growth in 2021 and 2022, as well as part of 2023 given the lag structure in the model.

The change to specialty is more significant. Specifically, we added some equipment types that were deliberately excluded when the model was built (e.g. on-site sanitation and mobile structures), other items that were once niche and have become more standard offerings (e.g. ground protection and loadbanks), and further items that were included, but which have gained broader application in rental (e.g. pumps and backup power). Since the adoption of specialty has been growing, the inclusion of these items changes history back 10 years. Since these segments are growing faster than “conventional” rental equipment, the inclusion also increases forecasted growth. The impact was to increase the rental market size by nearly $11 billion in 2023 and increase the forecast growth rate by nearly 400 basis points.

Rental Management: What factors are influencing the forecast for 2024?

Rental Management: What factors are influencing the forecast for 2024?

Hazelton: Whether interest rates are raised one more time in 2023 remains to be seen. However, the impact of past rate increases takes eight to 12 months to filter through the economy. Mortgage interest rates, for example, are expected to peak in 2024, although corporate bond rates are likely at their peak. The result will be a further slowing of most interest-sensitive sectors in 2024, notably home building, non-residential structures construction and durable manufacturing (except autos and aircraft). This is likely to slow the growth of construction and industrial equipment (CIE) rental, but growth conditions will remain.

Existing home sales will be challenged. While home renovation spending is expected to hold up, the nature of that activity, and the tools needed to complete it, will change from the kitchens and baths normally associated with existing home churn to roofing, siding and mechanicals (e.g. HVAC), which are necessary if one is to remain in the home longer. Similarly, tool rental into manufacturing, particularly of durable goods, will be held back by weak production levels. Again, growth will be there, but more limited.

Rental Management: A recessionary outlook was predicted in the past. What has changed?

Hazelton: The economy has proven somewhat more resilient than expected. However, the recessionary outlook always assumed a minor recession — a decline in real GDP [gross domestic product] growth of under one percent. The current outlook is for a “growth recession.” While that sounds like an oxymoron, recall that a recession is defined by falling GDP growth and rising unemployment. The outlook is for slowly rising GDP growth with rising unemployment. This is the layman’s definition of a growth recession — it feels like a recession because labor markets become less tight, but yet real GDP is still growing. This outcome is what I’ve been calling a “slower for longer” outlook. Without the recession, there is no recovery to boost growth; we just muddle along with real GDP growth of about 1 percent per year which is not sufficient to create the demand for strong capital expenditures. However, the difference in economic performance between recession and growth recession is not that significant.

Rental Management: What is the biggest risk to this forecast for 2024?

Hazelton: Inflation remains a factor in that we expect it to diminish and become less of a factor. This implies reduced cost increases, but also weaker ability to pass through rate increases. It also requires the supply chains remain stable, and that wage inflation comes under better control. These are the expected outcomes, which suggests that inflation will not be playing as large a role — however, inflation is a factor to the degree that these outcomes do not occur and further interest rate increases are expected.

At present, we are not concerned that global unrest influences 2024, but that situation is highly volatile and could change.

Rental Management: Do you have current data on the rental penetration index for the U.S.?

Hazelton: We estimate the rental penetration index annually, and for 2022 it was 53.8 percent — that is of the entire construction equipment fleet (at original purchase price), the rental industry owned 53.8 percent of that fleet. Rental penetration tends to rise in times of economic uncertainty, and when equipment demand outstrips production. It also does well when equipment transitions. We saw that with increases in engine tiers, and we expect it to continue with electrification of equipment. When we compute the values for 2023 early next year, I would expect penetration to approach 55 percent. The crux will be how we handle specialty equipment, which is not in the 53.8 percent measure. The dynamics of that equipment make future penetration projections a bit uncertain as of now.

Rental Management: How does the forecast for Canada differ from the forecast for the U.S.?

Hazelton: Canada’s rental outlook is significantly weaker than that for the U.S. Both economies performed with double digit growth in 2022. However, Canada faces many of the same challenges as the U.S., but to a greater degree. There was a housing bubble in Canada, while the U.S. market was tight. As such, we are seeing a stronger correction in Canada than in the U.S. Canada’s manufacturing economy is also weighted toward the slower growing industries. The combination is to send general tool growth slightly negative.

Canadian non-residential construction remains relatively stable, but it does not benefit from the federal funds that the U.S. is experiencing via infrastructure [Infrastructure Investment and Jobs Act (IIJA)] and structural [CHIPS for America Act and Inflation Recovery Act (IRA)]. We also expect stable commodity prices — although there is obvious risk to this scenario — which are more critical to Canada than the U.S. This is particularly true for oil prices, and oil capex is a key equipment demand source in Alberta and some Atlantic provinces.

Finally, I would note that the U.S. will see its strongest geographic growth in the southern and western states. For Canada, central provinces will see the strongest challenges with the best outlooks for the eastern provinces, and to some degree British Columbia.

ARA Rentalytics offers rental-specific industry data

ARA Rentalytics™, the American Rental Association’s (ARA) annual paid subscription service, offers ARA members — rental store owners and managers as well as manufacturers and suppliers — up-to-date economic data specific to the equipment rental industry.

The service includes valuable resources, including an annual product group purchasing forecast and access to ARA’s rental consumer surveys. In addition, a low-cost state digest for local rental companies was launched.

“ARA continues to meet our member needs by providing useful, pertinent information, like that found in our ARA Rentalytics platform,” says Tom Doyle, ARA vice president, association program development.

Offered exclusively to ARA members, ARA Rentalytics has four levels to choose from with each successive level providing more data, services and benefits starting with the state digest, which provides a one-year revenue forecast for the national, state and metropolitan statistical areas (MSAs) as well as data related to the national and state forecast economic drivers affecting the rental industry.

Other levels include state, regional and North America subscriptions, expanding the available data beyond what the digest provides.

“North America subscribers receive the exclusive rental revenue forecasts compiled by our expert partner, S&P Global Market Intelligence, get interactive and ready-built charts, and they are updated automatically with each quarterly release. This is a definite time-saver for professional rental managers, manufacturers and suppliers,” Doyle says.

Subscribers also are invited to quarterly webinars that provide additional information beyond what is available in the quarterly forecast as well as access to economic and rental experts.

For more information about ARA Rentalytics, visit ARArental.org/ARA-rentalytics. You also can contact Mike Savely, ARA director, association program development, at 800-334-2177, ext. 246, or mike.savely@ararental.org.